3 Ways Your Pennies Can Grow Significant Christmas Dollars

We may earn money or products from the companies mentioned in this review or post, but all opinions are our own.

Christmas can be a struggle for single-income families like mine. Three things help me save all year and now, I have $500 in my Christmas fund. Each little deposit was made without me thinking about it. Could you use some passive savings that add up to significant Christmas dollars?

Christmas spending has always been an area I want to be intentional and responsible. Even with a budget of $50 per family member, the Christmas celebration was a considerable stretch for our family. Let me share the two simple apps have been lifesavers for our family of twelve. Since using them, I have had the peace of knowing my Christmas fund is growing all year.

Watch Your Change Grow with Acorn

In Acorn, I have a digital change jar. Do you ever lug a loaded change jar to the bank? When we were newly married, we threw our change in a “Vacation Fund” jar. We accumulated over $250 when it was full, though we rarely took the vacation. A blown tire or broken appliance would more likely be handled with the extra savings.

We don’t use cash like we used to, the physical change jar is a thing of the past, but the digital change jar isn’t. With Acorn, I choose which bank accounts, debit and credit cards that I want to add to a digital round-up to. Each time I spend money, the change is added to my balance.

Round it Up for Good!

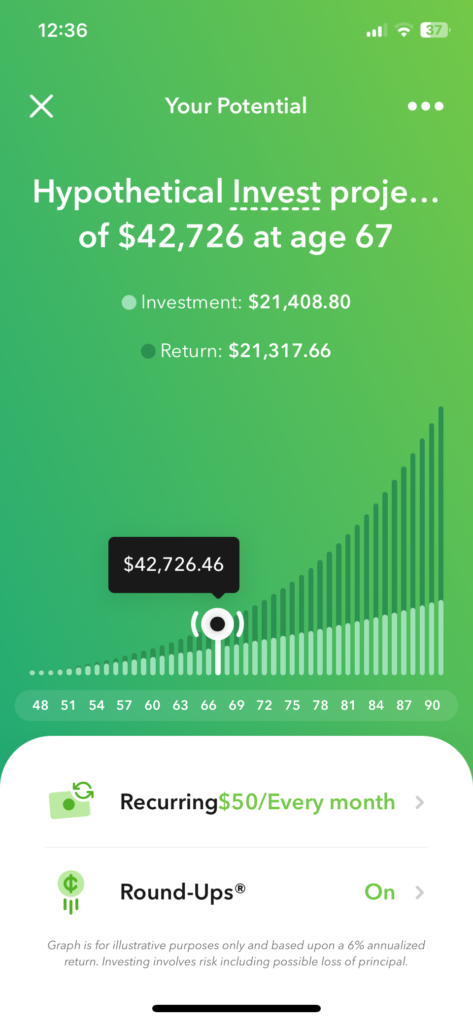

Say I pay $20.75. My payment is rounded to $21, and Acorn adds .25¢ to my account. Instead of several nickel-and-dime withdrawals, Acorn makes a deposit when I reach my chosen threshold of $5. I depended on my Acorn account for years to save enough for our kids Christmas gifts.

Now that I am also working, our income is more flexible. I choose to make a recurring monthly investment in our fund of $40. Acorn invests my deposits all year. I am earning a significant rate of over 10% interest right now!

Start with a tiny Acorn, and grow your financial plan into a mighty oak by learning about your finances, financial planning, and investing. I watch the Learn with Acorn videos in the app. They are digestible, informative, and a quick way to learn more about how your money works.

Grab the app for free and start learning with Acorn now. Save more with partner offers and you can upgrade to gold to invest in your kids future, get bonus matching investments, complimentary will services and more.

Click HERE to start saving with a $5 BONUS from Acorn right away.

Get Paid to Fill Your Tank

Do you know where the cheapest gas in your neighborhood is? Every time I get gas, I check my Upside app for the deals near me. Right now, I see the stations near me are offering .11¢-.13¢/gal cash back on regular.

I have my credit or debit card that I use to pay for gas linked to the app. Each time I get gas, I claim an offer, click the I PAID button and that is it. The best part is the more gas I get the better the offers I get.

Sharing with your friends is also a bonus opportunity that keeps on giving. You get a 1¢ bonus each time they fill their tank AND you will both get a 15¢/gallon BONUS on your next tank of gas too.

With Upside, I have saved $150 toward our Christmas fund. I can deposit the cash whenever I want to. This week, I moved my cash back bonus money into my Paypal account to Christmas shop.

You can also purchase digital gift cards in the app for 25+ different stores and sites. You can send your long distance loves a digital cuppa or a trip to Target! That is as easy as it gets.

Click this link or use promo code AMBER89933 to get an extra 15¢/gal bonus the first time you make a purchase. Then share your personal code to earn even more. With Upside, you will get something back every time you fill your tank!

Check Your Credit Card Rewards Policy

Be sure to check the website of your debit or charge cards. We have a business card for gas since we drive trucks. Every month credit card companies select offers on different types of purchases. Sometimes it is groceries, club purchases or gas.

Make sure you are saying yes to those offers. You can be earning cash back on purchases you are already making regularly. Also, check your card policy for bonuses that are offered year round as well. Many card companies offer deals on rentals, travel or hotels. We don’t travel much, but holidays are one of those time when we do.

Maximize Your Rewards for Significant Christmas Dollars

Stores like Sams Club offer rewards dollars on purchases. Check your rewards balances and be sure to use them up for the holidays. We were able to apply over half of the cost of our last shopping trip to rewards cash. You might have some significant Christmas dollars waiting for you right now.

Christmas dinner, paper goods and desserts are an added expense in December. It is nice to know you have a little bit of the cost of Christmas covered, but with some strategic planning, disciplined savings and the right tools, your next Christmas will be covered without having to think about it.

Got a hint?

What are you favorite way to save significant Christmas dollars incrementally throughout the year? Let me know and I will add it to my tweets! Find me @ https://x.com/200fingers_toes